Three months of Confirmation of Payee: Insights, learnings, and what’s next

Article snapshot

A look at how Fire’s Confirmation of Payee feature has performed over the past three months, common customer misconceptions, and our plans for its future.

How the Confirmation of Payee service has helped businesses over the past three months, common customer misconceptions, and our plans for its future.

–

Confirmation of Payee (CoP) is an account name-checking service designed to reduce misdirected payments. Launched in the UK in 2020 in response to rising Authorised Push Payment (APP) fraud, CoP was initially mandated for the six largest banking groups. However, its scope expanded significantly in 2024.

The Payment Systems Regulator (PSR) required all direct and indirect Payment Service Providers (PSPs) to implement CoP by 31st October 2024. As a result, more than 400 PSPs in the UK must now perform and respond to CoP checks before their customers can send payments via Faster Payments or CHAPS.

Designed to give payment senders peace of mind, the Confirmation of Payee service allows users to ensure that account details are correct before a payment is made. By verifying details upfront, it helps prevent mistyped account numbers and misdirected payments, reducing the risk of errors and fraud.

So what does this mean for you? With CoP now widely adopted, most sterling payments you send or receive will undergo a CoP check, providing reassurance that the funds are heading to the right account.

Confirmation of Payee’s performance

CoP helps businesses minimise the risk of misdirected payments by verifying account details before a transaction is made. This helps prevent errors that could result in lost payments or delays while also simplifying reconciliation. By ensuring incoming payments match the intended payer it reduces the need for manual checks, easing the administrative burden on the payer.

The Confirmation of Payee service is not limited to a specific industry and provides value across all sectors. Any business that regularly sends or receives payments in the UK can benefit from it. Whether managing high transaction volumes, processing refunds, or handling supplier payments, CoP adds an extra layer of security to Fire’s payments and accounts services.

Beyond operational benefits, CoP also strengthens customer confidence. Knowing that the payee’s details are verified before confirming the payment reassures customers that their money is going to the right recipient, reducing fraud concerns and fostering trust in the payer.

Since the wider implementation of CoP, businesses have reported smoother payment operations, fewer disputes, and improved customer relationships. By reducing errors and increasing transparency, CoP enhances the efficiency and reliability of payments and accounts for Fire and other providers.

Common misconceptions about CoP

How the Confirmation of Payee service works: A brief technical overview

CoP operates through the Pay.UK directory, which is a database containing information about all payment service providers connected to the UK clearing systems.

As the Payment Systems Operator (PSO), Pay.UK has created the rules and standards for the CoP overlay service and owns the product, including ongoing service developments, innovations, and industry communications. Organisations wishing to join the CoP service directly must be FCA or NCA regulated and authorised to perform payment service activities. Alternatively, Payment Service Providers (PSPs) can join indirectly through an aggregator with a contractual relationship with Pay.UK, which provides CoP solutions to multiple PSPs.

CoP facilitates confirmation requests between the sending and receiving PSPs. When a payer adds a payee, the sending PSP submits the recipient’s sort code, account number, and name for verification. The receiving PSP then checks whether:

- the account details are correct; and

- the account is open; and

- whether the provided name is a full match, close match, or no match with the account holder’s name.

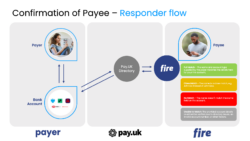

The responder flow applies when a payer is adding a Fire account as a payee. In this scenario, the payer’s bank submits the Fire account details to the Pay.UK directory for verification. Fire then checks the details provided and returns one of four possible responses:

- a ‘Full Match’, confirming the details are correct;

- a ‘Close Match’, indicating a slight name variation;

- ‘No Match’, where the name does not align with Fire’s records; or

- ‘Unable to Match’, which means the verification could not be completed due to issues such as an invalid account number.

Then Fire sends this information back to the payer’s bank, which displays the results of the CoP check to the payer.

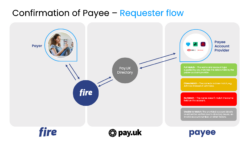

The requester flow applies when a Fire customer is adding a payee. The payer provides the payee’s account details, which Fire then verifies through the Pay.UK directory. The payee’s account provider responds with one of the four previously described possible outcomes: a ‘Full Match’, a ‘Close Match’, ‘No Match’, or ‘Unable to Match’.

This process helps ensure payments reach the intended recipient, reducing the risk of misdirected transactions. While many businesses already benefit from CoP, refining their approach can help prevent delays and enhance its effectiveness.

Common mistakes and how to avoid them

Trading names vs. registered names

Many businesses operate under a trading name that differs from their registered name. If a company has not informed its account provider of its trading name, the CoP check will not recognise it, leading to a ‘No Match’ response.

Solution

To optimise the rate of successful matches, businesses should ensure their account provider has recorded any trading names associated with their account. If a trading name is not registered, payers can ensure a smooth payment process by using the official business name linked to the bank account.

Missing or incomplete business names

When making a payment to a business, it’s important to enter the full legal or registered trading name. Even slight omissions can result in a ‘Partial Match’ or ‘No Match’ outcome, which may cause delays in receiving the payment as the payer may need to confirm the correct details.

For example, if a business is registered as Fire Financial Services Limited, but the payer enters Fire Financial Limited, the CoP check will return a ‘No Match’, potentially causing delays.

Solution

Businesses can help ensure successful matches by clearly communicating their full registered name on invoices, payment requests, and account details to support successful CoP checks. Payers should be encouraged to double-check that they are using the exact name as registered with the bank.

Other misconceptions and best practices

“CoP eliminates all fraud risks”

CoP helps PSPs support consumers and businesses in reducing fraud risks, but it is not a standalone solution. Payers should still follow best practices when making payments and assess whether a payment request seems out of place or unexpected. While CoP reduces the risk, fraudsters continue to adapt their tactics and may deceive individuals into transferring money, even with a successful CoP match.

Best practices to avoid fraud

CoP is an important step in reducing Authorised Push Payment (APP) fraud, but remaining vigilant is equally essential. We suggest always verifying the recipient independently and being cautious of impersonation scams. Here are a few things to consider that might help further protect against fraud:

- Be mindful of urgency: Fraudsters often try to create a sense of urgency to encourage quick decisions. If you receive a sudden or unexpected request, it might be worth taking a moment to think it through before acting, especially if there’s pressure to act quickly.

- Consider verifying through another channel: If a payment request comes via email, text, or phone call, it can be helpful to verify the details through a different communication channel to ensure its legitimacy.

- Watch for signs of impersonation: Fraudsters often impersonate trusted figures, like family members or colleagues. It can be useful to look out for small inconsistencies, like unusual language or mismatched email addresses, which may signal a potential fraud attempt.

Frequently asked questions

What should I do if there’s no match with the name I provided?

If a CoP check returns a ‘No Match, ’ rather than proceeding with the payment, it may be helpful to confirm the correct details with the payee. You could consider contacting the recipient directly to verify their registered account name. Additionally, it might be worth ensuring that the recipient is a trusted party. Feel free to read more in our FAQs about how you can identify if the request might be linked to a potential fraudster.

What information should I provide when requesting a payment?

To ensure a successful CoP check, provide the sender with your registered business name, along with your sort code and account number. You can verify your registered name in the Company Profile section of your Fire account.

How does Confirmation of Payee work?

When adding a new sterling payee, Fire, as your PSP, verifies the account name, sort code, and account number against the receiving bank’s records. There are four possible outcomes displayed to you, the payer, allowing you to review the message and decide whether to proceed with adding the payee.

- Full match – The details match, giving you peace of mind that the account information aligns with what you’ve entered, allowing the payee to be added without issue.

- Close match – The name is similar, and the system provides the actual account holder’s name for review. We recommend verifying the details and updating them if needed before trying again; however, you can still proceed with your payment if you choose to.

- No match – The name doesn’t match, and you are advised to contact the payee before proceeding and ensure they are a trusted party.

- Unavailable – A check couldn’t be completed due to reasons like a system timeout, customer opt-out, or an inactive account.

For more details, visit our FAQs page or feel free to reach out to our Support team at support@fire.com.

What’s next for the Confirmation of Payee feature?

Enhancing automation and efficiency

Currently, CoP is accessible through Fire’s mobile and desktop applications, allowing users to verify account details before completing transactions. To enhance efficiency and automation, we plan to introduce CoP through the Fire Payments API as an optional service. This will allow businesses to verify the account name of a UK counterparty against their account number and sort code when adding a counterparty or making a payment – automatically and in the background.

Staying ahead of regulatory changes

The European Payments Council (EPC) is introducing the Verification of Payee (VoP) scheme to enhance payment security across the Single Euro Payments Area (SEPA) and support compliance with the EU Instant Payments Regulation.

The SEPA scheme enables PSPs to send and receive euro payments across Europe. While migration to SEPA Credit Transfer and Direct Debit schemes is complete, further harmonisation is needed in areas like mobile and online payments.

From October 2025, payment service providers (PSPs) within the Eurozone will be required to adhere to the Verification of Payee scheme and register with the EPC Directory Service (EDS). PSPs outside the Eurozone must comply by July 2027, with an opt-out option available under certain conditions until January 2025. Further technical specifications, adherence processes, and interoperability standards for VoP are expected to be finalised by the EPC in 2025.

Fire is closely monitoring regulatory developments to ensure compliance and seamless integration into our payment solutions. Our experts actively participate in industry groups focused on fraud prevention, fund safeguarding, and regulatory compliance, shaping the future of secure payments. They also advocate for equal access and fair competition for e-money institutions (EMIs) and payment institutions (PIs), while staying engaged with ecosystem participants to remain at the forefront of regulatory changes.

Practical tips for optimising CoP

To help you make the most of CoP, we’ve pulled together some practical tips. These will help ensure smoother transactions, reduce errors, and improve the overall payment experience for your business and customers.

- Register your trading names with your account provider to avoid mismatches and ensure successful verification.

- Be clear with customers and provide them with your full business name and let them know it’s essential for making payments.

- Got a ‘no match’ response? Double-check the details with the beneficiary to spot any discrepancies and resolve them quickly.

- Keep things up to date and regularly review your account details to minimise potential issues.

Conclusion

Over the past three months, Fire’s Confirmation of Payee (CoP) service has enhanced payment security, reducing misdirected payments and streamlining transactions. By clarifying trading names and expanding fraud prevention measures, businesses are now fully leveraging CoP to ensure payments reach the correct recipient.

To avoid common pitfalls, ensure your trading names are registered with your account provider and clearly communicate required business names to customers. Our FAQs offer further guidance for navigating CoP confidently.

Fire remains committed to improving our payment services, including CoP and VoP enhancements, to help businesses stay ahead in the evolving payments landscape.

If you have any questions or need help with implementation, don’t hesitate to reach out. For further assistance, feel free to contact Fire’s support team to ensure your business is optimally set up for Confirmation of Payee. We’re happy to help guide you every step of the way.