The next phase of open banking payments: A practical guide to commercial Variable Recurring Payments

Article snapshot

This guide explores commercial Variable Recurring Payments (cVRPs) as a new phase in open banking, detailing their potential to streamline recurring business transactions, automate cash flow, and offer greater control for modern enterprises.

Exploring the role of cVRPs in open banking and their impact on enhancing payment processes for modern businesses.

–

Variable Recurring Payments (VRPs) are poised to be the next big step for open banking payments, offering a more efficient and flexible way for businesses and consumers to manage recurring transactions. In simple terms, VRPs allow customers to set up automated payments that adjust to varying amounts and frequencies, all with a single authorisation. Once approved, these payments are made automatically without the need for repeated consent.

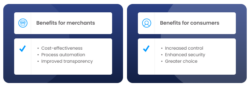

By building on the open banking framework, VRPs enable a more streamlined and secure payment experience. With the introduction of commercial Variable Recurring Payments (cVRPs), businesses will unlock new opportunities for automation, cost reduction, and improved transparency, while consumers will benefit from greater control and security over their payment details.

In this guide, we offer a clear and concise overview of VRPs, their role in open banking, and the upcoming rollout of cVRPs, while exploring their benefits, use cases, and future potential as open banking evolves.

Understanding VRPs and their role in open banking

What are Variable Recurring Payments?

Open banking technology enables the secure sharing of financial data between institutions, with the user’s consent, to offer innovative services, such as open banking payments.

Open banking payments allow businesses to initiate payments directly from a customer’s account with secure authentication. This method is ideal for one-off payments, like online purchases.

Variable Recurring Payments (VRPs) build on this framework, enabling recurring, automated payments with a single authorisation, all within agreed parameters.

The two types of Variable Recurring Payments

There are two types of VRPs, both designed to simplify recurring payments with a single authorisation, offering greater flexibility and control to the payer.

- Sweeping VRPs (me-to-me payments): These allow individuals to set up recurring payments between their own accounts, making them perfect for managing savings plans, credit repayments, or other personal transfers between accounts.

- Commercial VRPs (cVRPs): These enable businesses to initiate recurring payments from a customer’s account, much like a standard single domestic payment. This opens up exciting possibilities for businesses to automate payments and streamline operations.

While one-off open banking payments offer a convenient alternative to traditional card payments, bank transfers, or cash, commercial Variable Recurring Payments provide an innovative alternative to recurring payment methods like card-on-file, direct debit, or standing orders – offering businesses and consumers a more secure and cost-effective way to manage payments.

How VRPs and cVRPs can transform business payments

Benefits of commercial Variable Recurring Payments for merchants

cVRPs offer businesses a cost-effective alternative to traditional payment methods like direct debits or card-on-file payments. By leveraging account-to-account transactions, businesses can lower processing costs, making it an attractive option for recurring payments.

One of the standout benefits of cVRPs is automation. With customer consent, merchants can set up automated payment requests directly from a customer’s account of choice. This not only streamlines the payment process but also minimises the administrative workload and reduces errors commonly associated with manual payment handling.

Transparency is another key advantage. cVRPs empower consumers with greater control and visibility over their payment details. Thanks to mandatory Strong Customer Authentication (SCA), customers benefit from enhanced security and peace of mind – something that traditional methods like direct debits often lack.

Faster settlement timelines are another key benefit – while a direct debit or card transaction can take 3 days to settle, cVRPs would use account-based payments which are typically settled within one working day, if not instantly. This is a great advantage to businesses that need to combat the challenge of managing their cashflows.

Benefits of cVRPs for consumers

With cVRPs, consumers gain unprecedented control over their payments, enjoying clear visibility into key details such as payment limits, frequency, and the expiration date of their consent for recurring transactions.

Security is significantly enhanced through Strong Customer Authentication (SCA), which provides an extra layer of protection beyond what traditional methods like direct debits offer. The customer authenticates with the account provider of their choice – an entity they trust to hold their funds. By holding the SCA with their trusted provider, consumers gain confidence in the security of the payment method.

Additionally, cVRPs broaden the spectrum of payment options, empowering payers with greater choice and flexibility in how they manage their finances.

This combination of increased control, enhanced security, and expanded choices makes cVRPs a compelling alternative for both consumers and businesses alike.

Industry insights: Latest developments and future of VRPs and cVRPs

The outlook and industry sentiment for cVRPs is generally positive. A recent survey by Token.io and Open Banking Expo revealed significant merchant interest, with 57% planning to shift from card payments to cVRPs. This signals a major opportunity for cVRPs to transform traditional payment methods. Driving this innovation, key players across the payments industry, including Open Banking Limited (OBL) and Pay.UK, are leading the charge to make cVRPs a reality.

While the push to advance cVRPs is widely supported, several concerns remain about whether they can truly gain momentum in 2025. We’ve highlighted a few key areas that will need to be addressed for cVRPs to reach their full potential.

Contractual agreements

While the technology for delivering cVRPs is built on existing open banking frameworks, making it relatively straightforward to implement, the contractual side requires further development before they can be fully rolled out. A Multilateral Agreement (MLA) will be implemented to serve as the contractual framework between the various parties involved – ASPSPs, PISPs, and merchants. OBL has published a draft MLA document for industry consultation, which will run until 28th February this year.

Consumer protection

It is widely acknowledged that establishing a robust consumer protection framework and a dispute mechanism will be critical to deliver a secure and scalable solution. One of the questions OBL is raising in the MLA consultation mentioned above is whether the cVRP design provides “adequate protections” for customers.

Commercial model

Establishing a commercially viable model that incentivises all stakeholders – including payment service providers, merchants, and consumers – is critical. This may involve addressing complexities surrounding different risk factors depending on the use case. At the time of publishing this article, a commercial model is still in development. However, OBL expects to add it to the MLA after the ongoing consultation period concludes.

Resources and capacity

Although the majority of banks (79%) believe that cVRPs will be beneficial, currently less than a third of those surveyed are planning to support cVRPs by 2025.

Consumer adoption

Open banking payments have seen a slower-than-anticipated uptake, as highlighted by the UK National Payments Vision. The adoption of cVRPs will largely depend on establishing the right frameworks. Once these are in place, cVRPs could also play a key role in driving the adoption of open banking.

What’s next for commercial Variable Recurring Payments?

2025 promises to be an exciting year in the Open Banking space where cVRPs are likely to become more widely accessible in the UK, Europe and further afield.

Open Banking Limited is aiming to finalise the rulebook for cVRPs in Q1 of 2025, which is expected to address the considerations and concerns outlined above.

In parallel, OBL and Pay.UK plan to introduce cVRPs to different industries in a phased approach commencing in 2025, in what they call ‘waves’. It is likely the learnings from early phases could be used to feed into the frameworks and rulebook, with real-world experience to address those concerns.

The so called Wave 1, expected to take place in 2025, will see the introduction of cVRPs for UK industries that already offer strong consumer protections, namely regulated entities, central government agencies, local government, FCSC-protected financial services and charitable donations. The success of this first phase will pave the way for expanding cVRP adoption to other industries and use cases in subsequent phases, with the hope that cVRPs will be introduced for e-commerce payments next year.

In Brazil, where open banking payments have become quite popular, provider EBANX has announced it will launch it’s cVRP solution Pix Automático to merchants in June 2025, which is likely to have great success among a market that faces limited access to other payment methods.

The road ahead for cVRPs and open banking payments

cVRPs have the potential to accelerate the adoption of open banking payments, offering powerful benefits to both consumers and businesses. While the appetite for expanding open banking payments through cVRPs is evident, there are still challenges to address. The industry is progressing with a phased approach and a commitment to developing a robust framework. The initial cVRP rollout will provide valuable data and insights, which will inform future decisions and shape the future of open banking payments.

We welcome any thoughts you may have on the development of commercial Variable Recurring Payments. If you have questions or would like to discuss this topic further, please reach out to our team. Our experts are available to provide insights and assistance.