Enhancing payments for gaming companies with open banking

Article snapshot

Explaining how gaming companies can reduce costs and improve efficiency by leveraging Fire's open banking solutions to eliminate costly card fees and streamline payout processes.

Discovering how gaming companies can offer better payment options, reduce costs, and improve security with open banking providers like Fire.

–

In the fast-paced gaming industry, providing a seamless and secure payment experience is essential for both customer satisfaction and profitability. By expanding payment options and reducing reliance on traditional card processing, gaming companies can lower transaction costs and enhance payouts, with support from open banking providers like Fire facilitating these optimised solutions. With improved security and reduced fraud, gaming operators can focus on delivering a great experience while streamlining their payment processes.

Enhancing financial efficiency in the iGaming industry

While card processing fees and friendly fraud are considerations for gaming companies, they also present opportunities for innovation. By exploring ways to reduce fees, enhance fraud management, and streamline settlement times, gaming operators can drive greater profitability and payment efficiency, ultimately enriching the bettor experience.

Card processing fees

Card processing fees can impact the profitability of gaming companies, particularly when it comes to high-value payments. By seeking out innovative payment solutions, gaming operators can enhance their revenue potential while accepting payments in a more cost-effective manner, ultimately improving their overall financial performance.

Friendly fraud

The gaming industry faces challenges with ‘friendly fraud,’ where customers dispute legitimate transactions. While this can impact revenue and lead to chargeback fees, it also presents an opportunity for companies to enhance their fraud management strategies. By implementing robust solutions to address these issues, gaming operators can better protect their profit margins and create a more secure and trustworthy payment environment for their customers. Almost two thirds of chargebacks cannot be disputed, and those who succeed in challenging a transaction are 50% more likely to request another chargeback within the next 90 days.

What is open banking?

Open banking is a relatively new payment acceptance method that is gaining traction in the gaming industry. It simplifies the payment process, reduces costs and improves payment security.

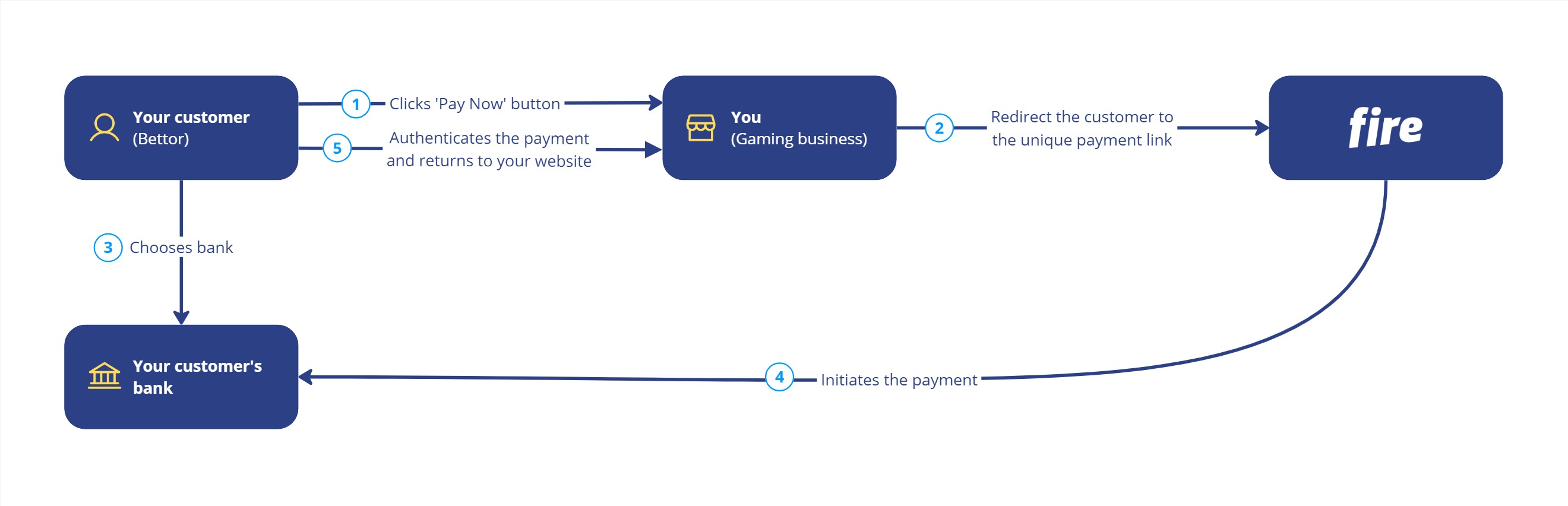

Open banking providers like Fire connect or integrate with account provider’s open banking APIs. You can then present your customer with a payment request link, and they will use Fire’s interface to choose their account provider.

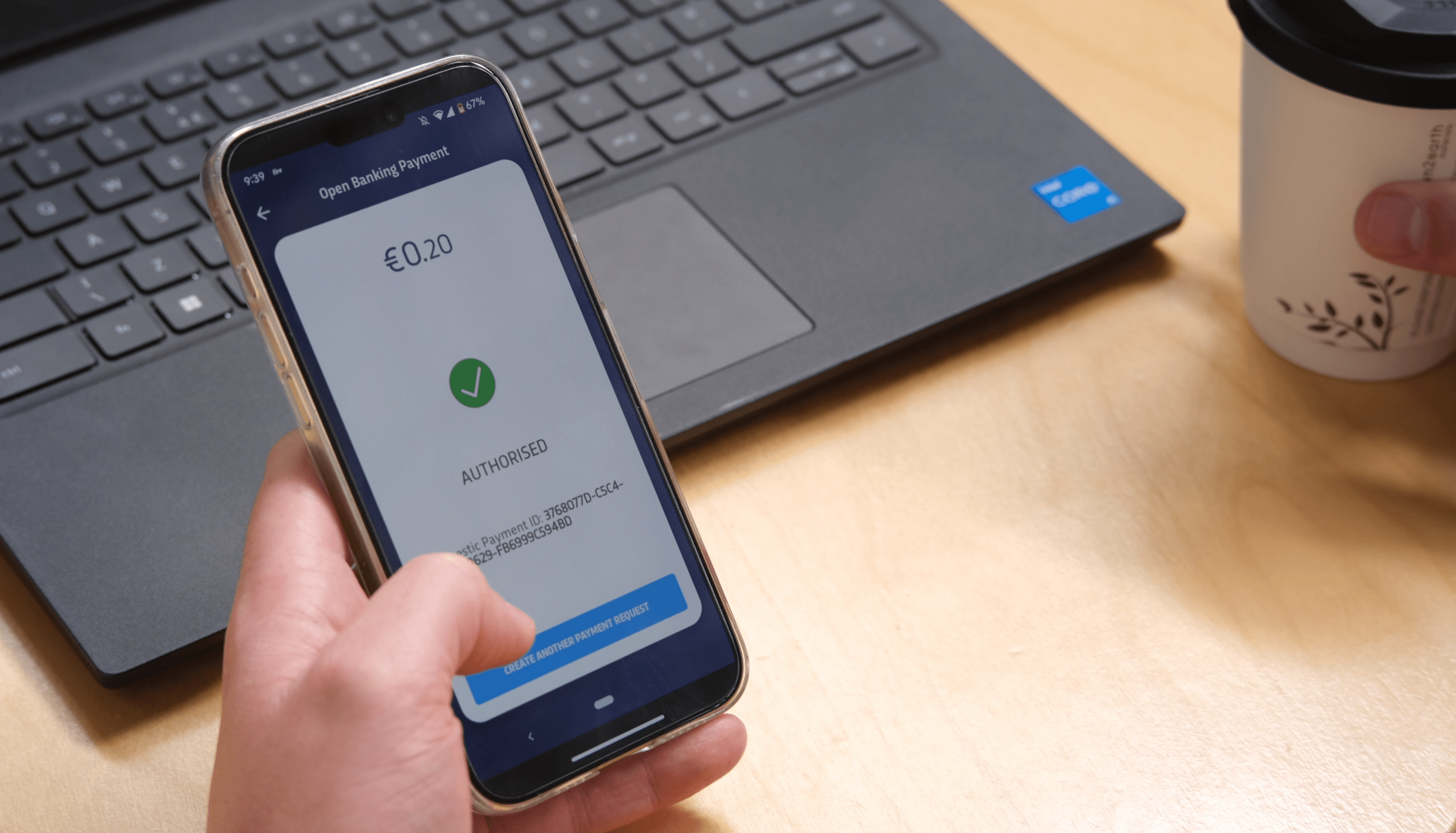

Fire will initiate the payment, bringing the customer to their banking app to authenticate and authorise the payment with Strong Customer Authentication, or SCA.

Open banking payment providers adhere to strict standards and regulations to ensure security, enabling customers to see the exact amount they are paying and the recipient at each step of the process.

How Fire’s solution reduces costs

With the help of open banking payment providers, gaming companies can significantly reduce costs associated with card acceptance, particularly for high-value transactions, while gaining more control over refunds, eliminating chargebacks, and automating payouts through a single, streamlined solution.

Optimising expenses

Since open banking payments rely on traditional account-to-account transfers, they present a compelling alternative to card acceptance for gaming companies. The cost per transaction can be significantly lower, especially for high-value transactions.

Control and oversight

Fire open banking payments allow you to control the refund process, so you can maintain an excellent customer experience while escaping the trap of friendly fraud. With open banking payments there are no chargebacks, so you can limit the payments you return to genuine disputes only. Refunds can be completed manually, or through the Fire Payments API.

Managing payouts

While open banking payment providers help companies get paid, gaming companies also need to manage payouts to their customers. Fire facilitates this by automating customer payouts through the Fire Payments API, enabling businesses to potentially handle all their payment needs with a single provider.

Implementing Fire’s solution: A step-by-step guide

To streamline your payment operations, start by assessing your current methods. Next, set up and integrate Fire’s open banking solutions. If needed, configure automated payouts, and continuously monitor and optimise your processes to ensure seamless transactions and enhanced control.

Step 1: Assessing your current payment processes

Evaluate your existing payment methods and identify areas for improvement.

Clearly defining your requirements at this stage will help you select the right provider. For instance, do you need a provider that facilitates payouts? Would you like the payment interface to be custom-branded?

Step 2: Setting up your Fire account

Getting set up with Fire is straightforward. The first step is to contact our sales team so we can learn more about you and your needs. You’ll then fill out a full application form with information about your business and documents.

Step 3: Integrating Fire’s open banking solutions with your platform

As a Fire customer, you gain access to all our payment services and can choose which ones to implement and how, with our team supporting you every step of the way.

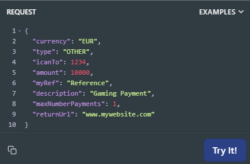

Integration to the Fire Payments API is simple. Once you have set up the API application and created the access token, you can use our Open Banking API calls to implement the solution.

You can send all the details you need for smooth reconciliation when creating the payment request. Our API will respond with a unique payment request to which you can redirect your customer. For example, this could be triggered when your customer clicks a ‘Pay now’ button in your app.

Step 4: Configuring automated payout workflows (optional)

Depending on your use case and requirements, you may want to automate the movement of funds after they are received. You can use our batch payments API calls to automate payouts to customers, or even move funds between your own Fire sub-accounts.

See here our blog post titled ‘Solving disbursement issues in payment processing’ to learn more about integrating batch payments.

Step 5: Monitoring and optimising your payment processes

Once your customer has completed the payment process, it’s important that you maintain oversight of the payment status. You can use the API to check for certain payment statuses that inform your backend systems when it is safe to fulfil the purchase. This also gives you the comfort of knowing when funds have been settled to your account.

Open banking payments in action

Gaming companies that get paid using Fire see reduced costs compared to the card fees they would otherwise be subject to. Gaming merchants also appreciate the security of using Fire’s open banking payments, as it allows them to avoid storing customers’ card data and reduces the risk of invalid chargebacks, all while receiving payments securely.

Read more about how Fire can support gaming companies.

Frequently Asked Questions

Can I still accept card payments?

Yes, open banking payments can be implemented alongside other payment methods, or as the sole payment method, depending on what works best for you and your customers.

What should I look for in an open banking provider?

This depends on your specific needs, and it’s certainly a good idea to look at what open banking providers are offering to find a good fit.

If you require multiple services such as opening multiple sub-accounts, or automating payouts, you may want to consider a provider that offers more than just open banking payments.

How can I start using open banking payments to get paid?

Getting started with open banking is relatively straightforward. With Fire, once you’ve completed the onboarding process you can complete a simple integration with our API to implement the solution. Our customers can go live and start accepting payments in as little as 3 to 4 weeks.

Cost-effective and secure payment solutions

Using a payment method that keeps costs low and payment security high is essential for the success of gaming businesses. Fire open banking payments help businesses to position themselves for long-term success in this competitive industry.

By embracing open banking, gaming companies can significantly reduce their costs, improve security, and enhance the overall user experience.

Getting started

Learn more about the benefits of Fire open banking payments here, or dive into the Fire Payments API to learn more about how it works.

If you’re ready to get paid using open banking payments, get in touch and our team will be happy to support you along the way.