Building growth through strategic partnerships in the payments industry (Part 1)

Article snapshot

In the first part of this article series, we explore the payments ecosystem, the key players involved, and how strategic partnerships help payment facilitators (payfacs) and independent software vendors (ISVs) drive growth.

An article series exploring how banks, acquirers, fintechs, independent software vendors, and payment facilitators (payfacs) can drive growth through strategic partnerships, innovation, and streamlined compliance.

–

This article is the first in a four-part series exploring how strategic partnerships drive growth by creating value, improving merchant services, and streamlining compliance. To read the second piece in this series, please refer to Part 2.

Introduction

The payments industry is evolving rapidly, with new technologies and business models reshaping how transactions are processed and managed.

Strategic partnerships are at the heart of this transformation, allowing key players such as banks, fintechs, independent software vendors (ISVs), and payment facilitators to combine their unique strengths and drive innovation. By collaborating, these stakeholders can deliver seamless, secure, and scalable payment solutions that meet the growing demands of businesses and consumers alike.

In this article series, we explore how these diverse players can create value through effective partnerships. We’ll also look at how they can streamline compliance and manage risk while unlocking new opportunities for growth. Whether through enhancing customer experiences, expanding service offerings, or navigating complex regulatory environments, these partnerships are crucial for staying competitive in the dynamic payments ecosystem.

Navigating the payments ecosystem

The payments ecosystem is a dynamic network of interconnected players, each playing a critical role in enabling seamless transactions.

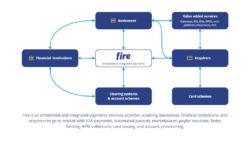

At the centre of this system are businesses, which rely on financial institutions, service providers like Fire, and acquirers to support their payment needs. Value-added services such as payment gateways, independent sales organisations (ISOs), independent software vendors (ISVs), electronic point-of-sale (EPOS) systems, orchestration platforms, fraud prevention tools, and dynamic currency conversion (DCC) enhance the payment process for businesses.

Financial institutions connect businesses with clearing systems and account schemes, while acquirers work closely with card schemes to enable businesses to accept card payments.

Fire acts as a pivotal link, offering embedded and integrated payment services that connect businesses, financial institutions, acquirers, and clearing systems to deliver account-to-account (A2A) payments, automated payouts, and other innovative solutions. Together, these entities form a tightly interwoven framework that powers the global payments industry.

Distribution channels in payments

Most companies rely on multiple business development channels and routes to revenue. Some are part of a strategic plan, while others evolve with technological advances or new regulatory frameworks that aim to stimulate the market. Historically, payment organisations have followed familiar pathways to attract customers, but today, those customers are often found through third-party relationships rather than directly.

Merchants are increasingly discovered through independent software vendors (ISVs), eCommerce platforms, independent sales organisations (ISOs), and other third parties, that provide business enablement services.

Whether a merchant is operating offline, online, or as a service provider, they are often supported by critical supplier partnerships that help enable their business operations. These partners offer software, services, and access to customers, creating multiple entry points into the payment ecosystem.

These third-party relationships are now the key target for payment organisations, who view them as essential to growth and customer acquisition. Payment facilitators (PFs or payfacs) are also reshaping the landscape by enabling faster payment acceptance, and through their role, many more points of interaction (POIs) are emerging each year.

Payment facilitators and independent software vendors

Payfacs are essentially ISVs that take on functions traditionally managed by acquirers and processors. Payfacs allow merchants to accept payments while also handling customer enablement, including navigating KYC, anti-money laundering (AML), and compliance processes. To successfully recruit and onboard merchants, payfacs must establish efficient partnerships that offer responsive support.

Payfacs are particularly effective in serving complex market segments by focusing on specific verticals and sub-verticals, offering tailored products and services that traditional payment participants may not provide. As a result, new payment acceptance options are constantly emerging, expanding the number of POIs.

Partnership roles & responsibilities

Successful partnerships depend on selecting the right participants who are committed to each other’s goals. Understanding the merchant’s needs, business model, and supply chain is essential for identifying how best to approach onboarding and enablement.

The onboarding process benefits when each party takes responsibility for the areas where they excel. However, combining strengths across different business verticals can be challenging, especially when legacy functions within acquirers and payment service providers need to be disrupted. Despite this, working with ISVs and payfacs is crucial for growth, as they can connect acquirers to merchants they might otherwise struggle to reach.

It’s important to note that partnerships based purely on commercial terms can be contentious. Both parties may end up disappointed if they focus too much on trying to claim the largest share of revenue. Successful partnerships are founded on trust, with both parties sharing the responsibilities of merchant onboarding, pricing, risk management, and compliance.

Compliance for growth

ISVs and payfacs are well-positioned to fuel growth in a merchant’s business by leveraging the management information systems (MIS) and data provided by their platforms. This data offers valuable business insights and helps manage risk, enabling long-term partnerships and growth.

However, taking on additional functions, such as licencing, compliance, and risk management, brings its own set of challenges. These responsibilities can divert focus from core business objectives and become a costly burden. Acquirers, processors, and financial institutions have different compliance obligations, and ensuring that these are met is critical to maintaining trust in the partnership.

Systematic risk management

Acquirers often view payfacs as “mini-acquirers,” holding them to high standards for risk management, fraud detection, and compliance with regulations. These expectations are typically outlined in the partnership agreement, with regular reviews to ensure compliance.

The key to successful partnerships lies in risk management. Acquirers must ensure that payfacs can operate within their compliance frameworks, including managing contingent liabilities, fraud, and chargeback events. As payment technologies evolve, there is a growing need for more agile, flexible solutions that meet the needs of these partnerships.

Benefits of partnering with Fire for payfacs and ISVs

For payment facilitators (payfacs), independent software vendors (ISVs), and acquirers, Fire acts as a valuable partner by handling the ‘last mile’ of payments – everything after the transaction.

While payfacs and ISVs focus on payment acceptance, Fire supports merchant onboarding, enables faster funding processes, and facilitates collections across multiple accounts and currencies. Payfacs and technology-driven payment platforms can also leverage Fire’s payout solutions to automate payment journeys, while cross-border providers benefit from Fire’s multi-currency capabilities to support merchants engaging with international customers.

Furthermore, Fire offers open banking as an alternative payment method, complementing existing payment systems. Together, Fire and its partners provide businesses with a fully integrated, end-to-end payment solution.

Conclusion

The payments ecosystem is constantly evolving, with businesses relying on a network of financial institutions, acquirers, technology providers, and payment facilitators to enable seamless transactions. As independent software vendors (ISVs) and payment facilitators (payfacs) play an increasingly central role in merchant enablement, partnerships between these entities and financial service providers are critical for driving growth. However, success in these collaborations depends on balancing responsibilities, managing risk effectively, and ensuring compliance with regulatory frameworks.

Fire provides essential support for ISVs and payfacs by enabling faster funding, automating payouts, and offering open banking solutions that complement existing payment acceptance methods. By working with Fire, payment providers can streamline their operations, enhance merchant onboarding, and expand their service offerings across multiple accounts and currencies.

In the next article within this series, we’ll explore the role of payment processors and how they fit into the broader payments ecosystem.